Skip to content

When people hang with Trump they perfect lying.

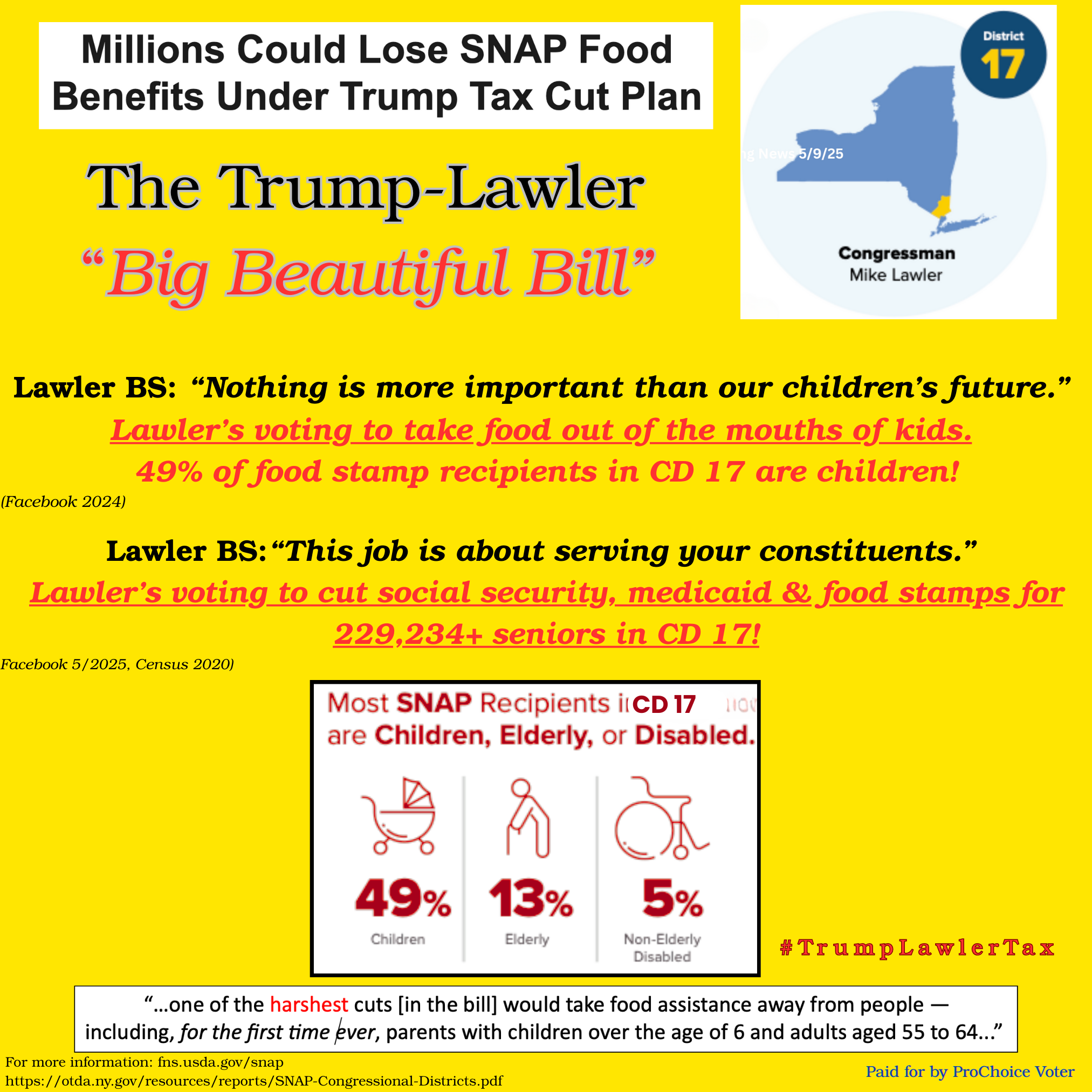

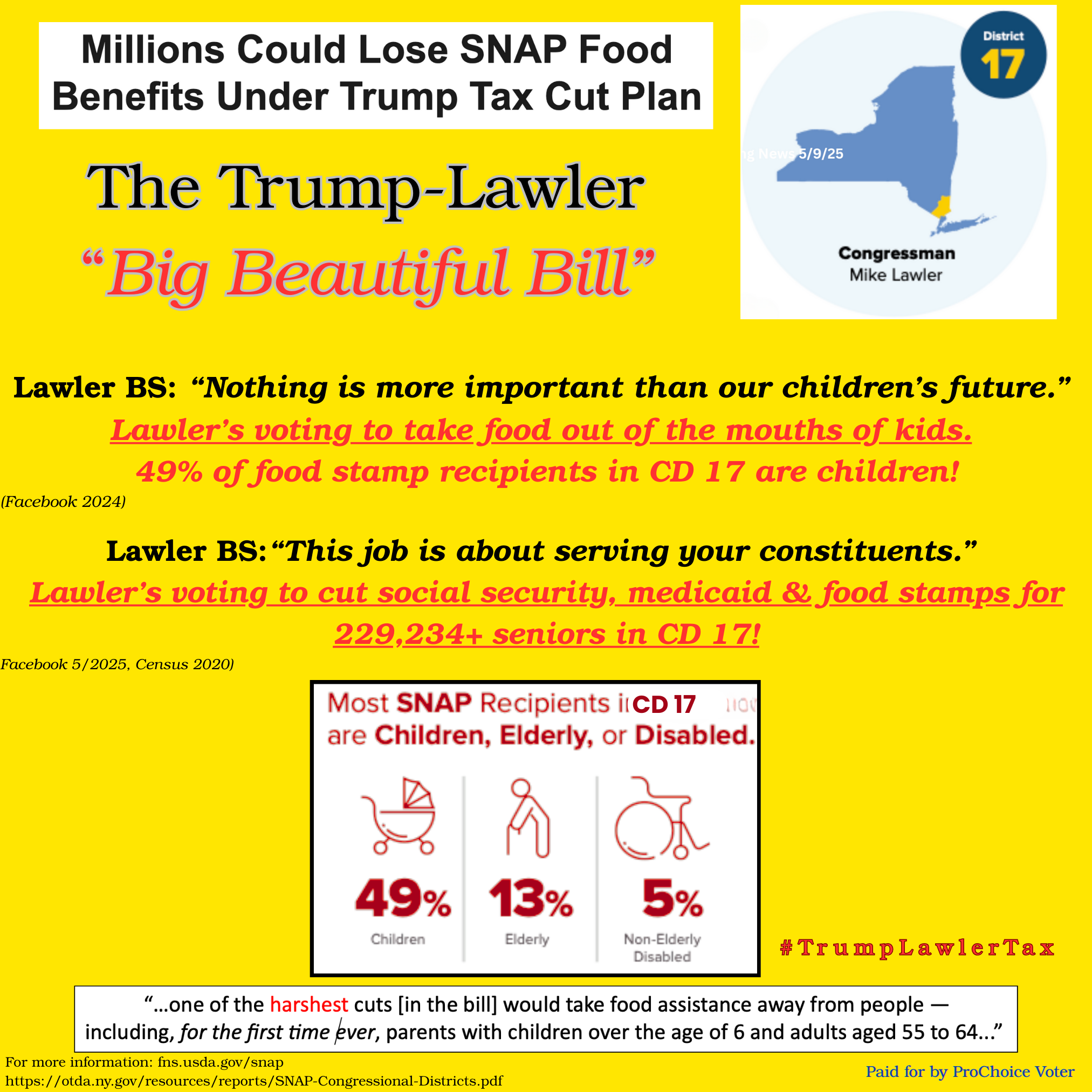

Lying Lawler claimed he wouldn’t touch food stamps, social security or medicaid. INSTEAD LAWLER voted for the largest cut to Medicaid in history, ripping away health care from over 2 million – and he voted to take food out of the mouths of our seniors & kids. #TrumpLawlerTax

“One analysis found that 60 percent of SNAP recipients are also enrolled in Medicaid and 40 percent of Medicaid participants receive SNAP.”

“Supplemental Nutrition Assistance Program (SNAP)

-

$290 billion: how much Congressional Republicans have proposed cutting from SNAP over the next decade, which amounts to nearly 30 percent of the program. New York received $6.5 billion in SNAP benefits in 2024, covering 18 percent of the state’s population.

-

$17.4 billion: how much New York could pay over the next decade if states are forced to shoulder a portion of SNAP benefits. Advocates are highlighting this particular provision as the largest rollback in the program’s history, which dates back to 1964. The federal government has historically covered 100 percent of food stamp benefits. The proposal would force states to cover between 15 to 25 percent of benefit costs based on tiers — New York would likely fall under the harshest tier of 25 percent.

-

670,000: the number of New Yorkers who will lose some portion of their SNAP benefits under expanded work requirements, according to estimates. Roughly 3 million New Yorkers used SNAP last year. Over half of SNAP households had children and 47 percent included seniors or a disabled individual.

-

75%: the share of SNAP administrative costs that New York will cover, including the distribution of electronic benefit cards. Currently, the federal government and states evenly split administrative costs. New York has been a hotbed for SNAP theft by criminal rings who exploit vulnerabilities in electronic benefit cards. As a result of skimming scams, thousands of New Yorkers have lost their SNAP benefits and the state has had to issue more replacement cards.

-

Freezing benefits: this proposal will affect every single SNAP recipient by preventing updates to the Thrifty Food Plan, a funding formula used to calculate monthly benefit rates. If enacted, recipients could see their benefit levels frozen despite record inflation and rising food costs. The average New York household received $376 in monthly benefits last year.

Medicaid

-

$715 billion: how much Congressional Republicans have proposed cutting from Medicaid over the next decade. Medicaid covers 6.9 million New Yorkers or roughly 35 percent of the state.

-

8.6 million: the minimum number of Americans who could lose healthcare coverage by 2034 under the proposed changes to Medicaid, according to a Congressional Budget Office analysis.

-

80 hours: the amount of time per month that “able-bodied” adults without dependents will have to work, spend in school, or volunteer in order to stay eligible for Medicaid. An analysis by the left-leaning Center on Budget and Policy Priorities found that 2 in 3 Medicaid enrollees already work and the remainder are either disabled, caregiving, or attending school. According to the Fiscal Policy Institute, nearly one million New Yorkers could lose their coverage under these requirements.

-

10%: how much federal funding will decrease for Medicaid expansion efforts if states, like New York, continue to provide health insurance for undocumented immigrants. The Fiscal Policy Institute estimates this would reduce federal Medicaid funding in New York by $1.9 billion annually.

-

$35: how much Medicaid recipients who make more than 100 percent of the federal poverty level will need to pay out-of-pocket for certain services per visit.

-

6 months: how often states will need to reassess individuals for Medicaid eligibility. Currently, Medicaid recipients reapply for the program annually. This requirement would likely place an administrative burden on New York’s county social service departments which have struggled in the past with backlogs for benefit programs.

-

Eliminating the MCO Tax: Republicans propose killing what’s called the “MCO tax,” an accounting trick that has allowed some states to temporarily generate billions in federal funds through Medicaid. New York just received federal approval for the tax and had factored in the projected revenue in its newly passed budget. According to the Empire Center, the sudden elimination could mean a $2 billion hole in the state’s budget once the bill is enacted.”